pix from here.

pix from here.A special shout out to bro Selva who's carrying his 11th kavadi in as many years. What a feat of devotion!

pix from here.

pix from here.For three decades, microfinance institutions have given out small loans to the world's poor--mostly women--and amassed hundreds if not thousands of case studies showing that the loans help alleviate poverty, improve health, increase education and promote women's empowerment. Skeptics, however, have argued there is not enough hard data to prove that microfinance transforms lives on a large scale, and they have called for more rigorous analysis.

Now two new studies have raised doubts about long-held beliefs in microfinance. The studies--which used randomized, controlled trial methodologies--did find that microloans helped poor entrepreneurs boost profits in their businesses. However, the studies found little impact on health, education, average consumption, women's decision making or self-reported well being.

The unexpected results, which were quickly picked up by The Economist and other media, created a stir in the microfinance community. "They don't capture what we believe is the real impact or dimensions of microfinance, which sometimes takes years to demonstrate," says Bruce MacDonald, senior vice president of communications at Accion International, a Boston-based non-profit involved in microfinance since 1973. "We would definitely disagree that microfinance doesn't have an impact on poverty because we have seen the impact over the past 30 years."

One problem with previous research, microfinance's critics respond, is self-selection--that is, studies only survey clients who successfully take out loans. The new studies differ from the past in that both attempt to measure the impact of microfinance by comparing two groups: one with access to microcredit and one without.

In the first study, researchers from the Massachusetts Institute of Technology (MIT) worked with a microfinance lender in India to look at 104 slums in Hyderabad. Half of the slums were randomly selected to receive a loan branch, while the other half were not. Fifteen to 18 months later, researchers interviewed 6,850 households in the community--about 65 per slum--in an attempt to gauge changes in economic and personal well-being.The second study, by Dean Karlan of Yale University and Jonathan Zinman of Dartmouth College, used a similar method to analyze microfinance in the Philippines, but instead of communities they looked at individual borrowers, tracking a total of 1,601 marginally credit-worthy loan applicants in Manila. Half were randomly offered a loan; half were denied. Researchers interviewed the sample group 11 to 22 months later to see if anything had changed. In both cases, results were mixed.

"While microcredit succeeds in affecting household expenditure and creating and expanding businesses, it appears to have no discernible effect on education, health or women's empowerment," states the India study. "Of course, after a longer time, when the investment impacts (may) have translated into higher total expenditure for more households, it is possible that impacts on education, health or women's empowerment would emerge.

However, at least in the short term (within 15-18 months), microcredit does not appear to be a recipe for changing education, health or women's decision making. Microcredit therefore may not be the miracle that is sometimes claimed on its behalf, but it does allow households to borrow, invest, and create and expand businesses."

The Empowerment of Women

Alex Counts, president of Washington-based Grameen Foundation USA, calls the studies "preliminary" and believes the timeframe is too limited to be meaningful. He cautions against making sweeping generalizations about microfinance on the basis of two studies, given how environments can vary from country to country.

A better measure, he argues, is research his organization commissioned in 2005 that analyzed 90 major impact studies and found that microfinance had positive effects. Counts also questions the Manila results based on the lender involved. "They studied a microfinance institution that is in no way typical of good microfinance practice in the Philippines," Counts says.

For microfinance practitioners who focus on women's empowerment, the results of the studies were particularly surprising. The India study found no impact on women's decision making, while the Manila study found some evidence that microcredit helped men more than women.

"It surprised me but I also felt that it was leaving something out," says Mary Ellen Iskenderian, president and CEO of Women's World Banking. The 30-year-old New York-based institution, which works with 40 microfinance lenders in 28 countries, has "solid data" from numerous studies around the world that shows women who take out microloans experience a decrease in domestic violence. Women's empowerment is "infinitely harder to measure but every bit as important as the economic change," says Iskenderian, who sees the empowerment factor come up in many studies. "It's borne out by data as well as [by] speaking to the women themselves."

Indeed, it may not be practical--or even possible--to measure poverty alleviation or profound social changes with randomized controlled trials, some say. Microfinance is too complex, its programs too varied. Loans are all different sizes for different types of businesses, and villages and families are never exactly the same. As microfinance grows and expands, it has become more difficult to isolate a "control group," especially in urban areas, because communities not served by one microfinance institution may still have access to another. Iskenderian recalls hearing of one attempted study that had to regroup after researchers discovered women in the control group (the village denied microfinance) were secretly sending their daughters to apply for loans in the next village, where credit was available.

Despite controversy over methodology, the two studies reflect a recent push in the microfinance industry to better measure social performance, says Wharton management professor Keith Weigelt. In recent years, as an increasing number of for-profit lenders have entered a market once dominated by non-profits and aid agencies, experienced practitioners have become concerned that microfinance is straying from its original mission of social development--what those in the industry call the "double-bottom line."

Meanwhile, microfinance institutions and their donors have stepped up efforts in the past few years to improve transparency and impact assessment. The Grameen Foundation and the Consultative Group to Assist the Poor (CGAP), the microfinance research arm at The World Bank, commissioned the development of the Progress out of Poverty Index (PPI) to help microfinance institutions measure social impact.

In 2008, the MasterCard Foundation, a large microfinance donor, gave $740,000 to the Microfinance Information eXchange (MIX) to help launch a web platform to track performance. And large donors such as The Bill and Melinda Gates Foundation have financed increasing numbers of studies on microfinance. "It's an evolution of the industry that we are seeing more studies being done," according to Weigelt. Finding an accurate measure of social impact is "the holy grail."

Rachel Glennerster, executive director of the Abdul Latif Jameel Poverty Action Lab at MIT and co-author of the India study, believes her work attracted so much attention in the press because it filled "a gaping hole" in microfinance research. "There were lots of questions being asked: Does it work? What does it really achieve? And there just wasn't really good evidence to answer the questions," she said. "So you fill a gap. You answer a question that people desperately want answered."

The Complexity of Poverty

While most microfinance practitioners say they welcome the data and look forward to more studies, not everyone agrees how and what those studies should measure next. Some acknowledge that they always knew the limitations of microfinance, and never claimed it would work miracles. They say that 30 years of surveys provide ample support for microfinance's social benefits, and should not be dismissed because of two studies. Others find flaws in the new studies themselves: The timeframe is too short, the scope is too limited, and randomized controlled trials are more suited to measuring something very specific--like the effect of a drug--than something as complex as poverty. Still, others say this is a blessing in disguise--an opportunity to rethink and regroup as microfinance matures into its next phase.

Although inconclusive on their own, the recent studies "mark a milestone" in microfinance research, states David Roodman, research fellow at the Center for Global Development. Roodman, who admits he has "spent way too much time taking apart studies" on the impact of microfinance, says he has been "almost universally unconvinced" by studies of the past. In June 2009, Roodman co-authored a working paper titled, "The Impact of Microcredit on the Poor in Bangladesh: Revisiting the Evidence," with New York University professor Jonathan Morduch that appears to upend one of the industry's most oft-quoted bodies of research--field surveys done in Bangladesh in the 1990s that Grameen Bank founder and 2006 Nobel Peace Prize winner Muhammad Yunus often cites as proof that 5% of the bank's borrowers pull themselves out of poverty each year.

Roodman insists he isn't skeptical of microfinance itself, but believes the data gathered up to now have not conclusively proven any benefit on average. "The real problem is that this data doesn't answer what we want it to answer," he says. "My stance has always been 'show me.'" By using a randomized controlled trial method, considered "the gold standard in drug trials," the new studies offer more credible data than microfinance has had before, Roodman says. "An intellectual revolution has arrived at the doorstep of microfinance."

What purpose the data actually serve is not easily answered. Michael Chu, a management professor at Harvard Business School, an expert in microfinance and former president and CEO of Accion, points out that health, education, finance and poverty are often tightly intertwined. A microloan might help a family start a business, for example, but if a single family member suddenly falls ill, the borrower might be unable to keep the business going--and will probably sink every penny the family has into emergency health care, he says.

Using randomized controlled trials to test something very exact--such as effectiveness of working capital--could be useful, according to Chu. Aside from that, he questions if so much precision is necessary. "What are you trying to do? Are you trying to get to the precision of academia? Or decision making? Because for certain parts of the academy, it may make sense to see if it was 53% or 57%, the impact of X.

But for a decision maker, whether it's somebody in the government trying to act against poverty, somebody on the front lines managing microfinance institutions, or somebody in a philanthropic organization trying to decide where to deploy the dollars, that's another level of decision making. In that case, a) you need to act, and b) do something that's intelligent. ... What level of precision do you need? We're discussing poverty. Urgency matters. Of course you can sit on the sidelines and wait for all these trials, but if you need that kind of precision to act, you're never going to be at the forefront of social action."

Others say microfinance has never been a silver bullet to alleviate poverty, and that financial access itself is enough of a goal. "It's somewhat narrow to define the value of microfinance intervention just as poverty alleviation," says Eliza Erikson, who manages the microfinance portfolio for Calvert Foundation, a nonprofit in Bethesda, Md., that focuses on socially responsible investment. "The benefit of microfinance isn't necessarily poverty alleviation but extending access to financial services, which allows people to remain stable and not live such precarious lives. There's a very tenuous line between being poor and being destitute."

The Next Wave of Research

Most people who live in poverty actually have extremely sophisticated financial lives, in part because their incomes fluctuate wildly from one day to the next, says Morduch, the New York University professor, in his new book, Portfolios of the Poor: How the World's Poor Live on $2 a Day. Having access not only to credit but also to savings, insurance and remittances would bring benefits to the poor by helping them stabilize their lives, according to Morduch. A secure savings account or an insurance policy might not lift a person out of poverty, for example, but it might alleviate an enormous amount of stress and help him or her avoid financial catastrophe.

Those benefits are unlikely to show up in the results of a randomized, controlled trial, however. "Portfolios of the Poor shows that people are looking to better manage their resources--not to grow a business necessarily, but to cope better with the ups and downs," says Morduch. "They're looking for things that are not so easily picked up by these kinds of studies."

Others say more studies are needed on the different types of microfinance and how it can be used in conjunction with other programs. "Microfinance is only one tool," says Donna Katzin, executive director of Shared Interest, a New York-based nonprofit that facilitates microloans in South Africa. "It's most productively used when it's combined with other strategies to build social capital as well as financial capital." For example, microfinance programs can be paired with education or health programs to achieve greater social benefits than if they focused on business alone, she adds. The studies "will really become useful to us when they help us discern which microfinance strategies have the most impact."

Waiting in line to add to the new research is Wharton business and public policy professor Santosh Anagol, who is currently planning a study that might help answer such questions. Anagol is setting up a randomized, controlled trial in Uttar Pradesh, a province in northern India, to study about 70 rural villages split into three groups. One village will receive access to microcredit, most likely through a loan officer from a for-profit microfinance institution who will visit the villages on a regular basis. The second group will receive microcredit in conjunction with some type of training program focusing on women--possibly a program about health, literacy or empowerment. The final group will receive neither service.

Anagol hopes the study will yield findings not only about the impact of microfinance on poverty but also on gender empowerment. "One of the things that both the aid community and academics are thinking about is, 'Is there a way to leverage microfinance to [promote] other types of services?'" Anagol says. The project is still in the early stages and will likely take at least three years to complete. "That's one of the weaknesses of these randomized evaluations. They do take a lot of time and resources."

Katie Torrington, who facilitates studies about the impact of microfinance on clients for Washington-based FINCA International, is looking forward to the next wave of research. She says it's probably time for the industry to step back and take a fresh look at its work after years of rapid growth. In the 1980s, simple success stories were enough to fuel the industry, and in the 1990s, the focus turned to refining financial performance standards.

The next logical step is social performance. "Now, as the industry is maturing, quite rightly we're also refining our measurement processes," she says. "This is a jumping off point, and we need to replicate studies like these in more locations. ... Every 10 years or so you want to stop doing business as usual and say, 'How are things different now?' We don't view it with fear. It's an opportunity."

THE effect of free money is remarkable. A year ago investors were panicking and there was talk of another Depression. Now the MSCI world index of global share prices is more than 70% higher than its low in March 2009. That’s largely thanks to interest rates of 1% or less in America, Japan, Britain and the euro zone, which have persuaded investors to take their money out of cash and to buy risky assets.

For all the panic last year, asset values never quite reached the lows that marked other bear-market bottoms, and now the rally has made several markets look pricey again.Aside from high asset valuations, the two classic symptoms of a bubble are rapid growth in private-sector credit and an outbreak of public enthusiasm for particular assets. There’s no sign of either of those. But the longer the world keeps its interest rates close to zero, the greater the danger that bubbles will appear—most likely in emerging markets, where growth keeps investors optimistic and currency pegs import loose monetary policy, and in commodities.

Central banks have a range of tools they can use to discourage the growth of bubbles. Forcing banks to adopt higher capital ratios may curb speculative excesses. As Ben Bernanke, chairman of the Federal Reserve, argued this week, the rise in American house prices could have been limited through better regulation of the banks. The most powerful tool, of course, is the interest rate. But central banks are wary of using it to pop bubbles because it risks crushing growth as well. And, with the world economy in its current fragile state, they are rightly unwilling to jack up interest rates now.

But even if governments judge that the risks posed by raising rates now outweighs that of keeping them low, investors still have plenty of reasons to worry. The problem for them is not just that valuations look high by historic standards. It is also that the current combination of high asset prices, low interest rates and massive fiscal deficits is unsustainable.

Interest rates will stay low only if growth remains slow. But if economies grow slowly, then profits will not rise fast enough to justify current share prices and incomes will not rise far enough to justify the prevailing level of house prices. If, on the other hand, the markets are right about the prospects for economic growth, and the current recovery is sustained, then governments will react by cutting off the supply of cheap money later this year.

But the more immediate risks may be posed by fiscal policy. Many governments responded to the crisis by, in effect, taking the debt burden off the private sector’s balance-sheets and putting it on their own. This caused a huge gap to open up in government finances.

The speech delivered by Tengku Razaleigh Hamzah at the ISEAS Regional Outlook Forum 2010 at the Shangri-la Hotel, Singapore on January 7, is a good reminder of the many challenges that needs to be addressed by a responsible Malaysian leadership. I have taken the liberty to highlight in bold, the pertinent parts of the speech that resonate with me.

The centre of gravity of global economic activity has been moving eastwards towards Asia for quite some time now. The present global financial crisis has accelerated that process.

Asian economies, led by China, seek to spur domestic demand and increase intra-regional trade. As the global appetite for treasuries and US equities decreases, it is likely that large flows of risk capital will start moving to emerging markets again over the next six months. The main destinations will be India and China, but the countries of Southeast Asia are also set to benefit from these flows of global capital to the extent that they have an economic story to tell. The two top performers are going to be Indonesia and Vietnam. Indonesia, the new “i” in BRIIC, has a market-size, natural resources and liberalisation story while Vietnam has a large and industrious labour force that is skilling upwards rapidly. The Philippines and Thailand, despite political worries, remain relevant for their large domestic markets while Singapore, as the financial hub of the region, benefits from any increase in regional economic activity. This year also sees the full implementation of AFTA and the signing of more regional FTAs. We can be cautiously optimistic about the basis for growth in trade and investment.

I mentioned the major Asean countries but not Malaysia in my list of investment destinations. That is because Malaysia has fallen off the map for much foreign investment. With neither the cost and scale advantages of Vietnam and Indonesia nor the advanced capabilities of Singapore, Malaysia is firmly caught in a middle-income trap and appears to have fallen off the radar screen of foreign investors. It might seem puzzling that this country, sitting at the heart of Southeast Asia, blessed with extraordinary natural, cultural and human capital, and once a beacon in the developing world, has become irrelevant.

I want to discuss how this happened, and reflect on what this story might teach about larger issues of common concern. Other members of Asean might be concerned that a country that was once at the forefront in spearheading regional initiatives is at a crossroads over its own future.

The general election of March 2008 was a watershed in Malaysian politics. The ruling Barisan Nasional coalition lost its accustomed two-thirds majority in the Parliament, and lost five states to the opposition, including the economic backbone states of Selangor, Perak and Penang. Compared to the ebb and flow of power in other parliamentary democracies, you might not find this a remarkable development. Against the backdrop of Malaysia’s political history, however, the entire political landscape had changed overnight. Gone was the invincibility of Umno, the Malay-based party that has dominated Malaysian politics since independence. The political credibility of Umno/BN had been more than just a set of racially-based political parties. Over its decades of ascendancy, history had been re-written, mythology created, and the party abolished and reinvented to reinforce the necessity and inevitability of a government led by Umno.

The formula of communal power-sharing that the Barisan Nasional and its predecessor were built on had started life as a political accommodation, a nation-building compromise, a way-station on the road to a fuller union of our citizens. Fifty years later it had ossified into the appearance of an eternal racial contract, a model replicated at every level of national life. The election results plunged this model, and the regime built upon it, into crisis.

The people are often ahead of their government. They are interested in more things than identity politics. Unable to respond to the reality that the BN formula is broken and the people want more than ethno-religious politics, the ruling party appears to be reacting by digging itself deeper into narrow racial causes with no future in them. This desperate response is self-defeating in a cumulative way. As Umno is rejected by the voters, party members pursue racial issues more stridently. They think this will shore up their “base”. They are mistaken about the nature of that base. As they do so, they become more extreme and out of touch with ordinary voters of every race and religion whose major concerns are not racial or religious identity but matters such as corruption, security, the economy and education.

Umno’s position in the present controversy over the use of the term “Allah” by non-Muslims is an example. In a milestone moment, PAS, the Islamic party, is holding onto the more plural and moderate position while Umno is digging itself into an intolerant hardline position that has no parallel that I know of in the Muslim world. Umno is fanning communal sentiment, and the government it leads is taking up policy lines based on “sensitivities” rather than principle. The issue appears to be more about racial sentiment than religious, let alone constitutional principles.

In a complex multiracial society a party and a government whose primary response to a public issue is sunk in the elastic goo of “sensitivities” rather than founded on principle, drawn from sentiment rather than from the Constitution, is already short of leadership and moral fibre. Public life is about behaving and choosing on principle rather than sentiment. Islam, in particular, demands that our actions be guided by an absolute commitment to justice for all rather than by looking inward at vague “sensitivities” of particular groups, however politically significant. It is about doing what is right rather than protecting arbitrary feelings. If feelings diverge from what is right and just, then it’s time to show some leadership.

“Sensitivities” is the favoured resort of the gutter politician. With it he raises a mob, fans its resentment and helps it discover a growing list of other sensitivities. This is a road to ruin. A nation is made up of citizens bound by a shared conception of justice and not of mobs extracting satisfaction for politicised emotional states.

As a mark of our decline, at some point in our recent history the government itself began to speak the language of sensitivities. In the controversy over whether Christians are allowed to use the term “Allah” the government talks about managing sentiment when it should be talking about what is the right thing to do. This is what government sounds like when a political system and its leadership have come unstuck from the rule of law. It goes from issue to issue, hostage to the brinksmanship of sensitivities. Small matters threaten to erupt into racial conflict. The government of a multiracial society that cannot rise above sentiment is clearly too weak or too self-interested to hold the country together. It has lost credibility and legitimacy. The regime is in crisis.

The deterioration of our political order did not happen overnight or in isolation. It is part of a more general pattern of the decline of democracy and the rule of law in many newer democracies. Many post-colonial societies that began with democratic institutions saw democracy collapse afterwards into dictatorship. I can think of Nigeria, Pakistan and Kenya, for example. What has not been said is that underneath the appearance of continuity, and over two decades, Malaysia has quietly undergone the same process. There has been, beneath the surface, a decisive rupture with the federal, constitutional and democratic system upon which we were founded, and which alone confers legitimacy. What replaced it was an authoritarianism based on personality. Policy was set according to personal whims of the leader, which is to say that in areas such as the economy and foreign affairs, the country was run according to the personal enthusiasms and pet peeves of individual leaders.

Power was consolidated and constitutional government turned back. The result was a recession to authoritarianism and the centralisation of power, abetted by the corruption of the ruling party. The ideology of the ruling party, which had combined Malay nationalism with an overriding national concern, was vulgarised into an easily manipulated politics of group resentment.

Umno started in 1946 as a grassroots-based party that commanded the idealism of my generation. After 1987 it was transformed into a top-down patronage machine. Party membership became a ticket to personal gain. The party attracted opportunists and ne’er do wells while good people stayed away in droves. For any organisation this is a death spiral.

The challenge of Umno and of Malaysia today is not simply reform but restoration, not simply democratisation but re-democratisation. This is because we are not building from scratch but trying to recover from the decline of once-excellent core institutions.

There are regional implications to Malaysia’s crisis. The formation of the Federation of Malaysia in 1963 precipitated a regional conflict to which, in part, the formation of Asean in 1967 was meant to be a solution. Now in a clear sign of the erosion of the rule of law, agreements that structured state-federal relations over matters such as the distribution of the petroleum revenue are casually ignored. Malaysia is a federation of sovereign entities, but one of the consequences of authoritarianism has been that it has come to be run habitually as a unitary state. We have to learn again how to be a federation.

Let me try to draw some conclusions:

Shortcuts in governance may appear to work for awhile, but they wreak long-term havoc on the institutional capability of a nation. Short-term boosts to the economy are difficult to evaluate when 40 per cent of the national budget come from a single source which does not report financial details either to the public or to Parliament.

What is clear is that there is no secure basis for long-term growth without a return to strong institutions, transparency and good government. The challenges of economic development, nation-building and institutional integrity are linked, more so in a complex country like Malaysia.

The success of Asean collaborative measures depends on the core countries taking a lead, and it is in everyone’s interest that these countries have strong democratic institutions and the rule of law. When countries lack good governance and transparency, domestic economies falter, domestic politics goes from crisis to crisis, and the country turns inwards and away from engaging constructively with the real world and with their neighbours.

The economic success of Asean economies up to the Nineties was based in part on the superiority of their institutional frameworks to those of Eastern Europe and South America. In the early days, Malaysia and Singapore played leading roles in Asean. Of late, Malaysia’s role has diminished, while that of Indonesia has grown. It is no accident that this is the result of successful reform and democratisation in Indonesia and the failure so far of any such process in Malaysia. Over the longer term, reform and democratisation must go hand in hand for there to be sustained economic development.

The present Prime Minister has made some helpful gestures towards liberalising the economy and pursuing more multiracial policies. These initiatives, however, must do more than skim the surface of what must be done. Malaysia is in need of fundamental reform. The reforms we need include, at minimum:

a. An overhaul of the party system which rules out racially exclusive parties from facing directly contesting elections. This will inaugurate a new era of post-racial politics.

b. The restoration of the independence of the judiciary and the freedom of the media.

c. An all-out war on corruption, the root of all the evils in nation-building and economic development.

The greater economic collaboration we aspire to in Asean requires that we pay attention to the internal conditions in each country that make it possible. We need to place the promotion of governance and institutional reform on the Asean agenda. I hope this is a matter you see fit to take up.

BAHAWASANYA NEGARA KITA MALAYSIA mendukung cita-cita hendak :

MAKA KAMI, rakyat Malaysia, berikrar akan menumpukan seluruh tenaga dan usaha kami untuk mencapai cita-cita tersebut berdasarkan atas prinsip-prinsip yang berikut :

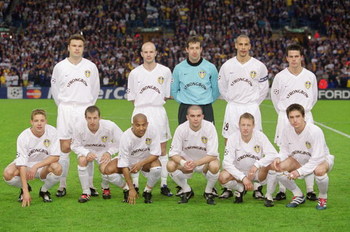

Jermaine Beckford's winner gave League One leaders Leeds a famous FA Cup victory over their fierce rivals Manchester United in a thrilling tie at Old Trafford.

Forty-two league places separate the two clubs following the Yorkshire club's dramatic fall from grace during the last decade but Simon Grayson's side showed the rate of their recent revival with a memorable triumph.

Man Utd had never before lost in the third round of the Cup - or been knocked out of it by a lower-division side - during Sir Alex Ferguson's 23-year reign as manager - but they began 2010 on the wrong end of their biggest upset in this competition since they were dumped out by Bournemouth in 1984.

It was a fully-deserved win for Leeds too, who were full of endeavour coming forward before Beckford outpaced the Man Utd defence to score and, just as importantly, defended as if their lives depended on it afterwards.

Grayson's men came into the game unbeaten in 15 games and having lost only twice all season but they were still expected to be brushed aside by the Premier League side, who themselves have found form since their defensive injury crisis abated.

True, Ferguson made seven changes to the side that thumped Wigan earlier in the week, but he kept Dimitar Berbatov and Wayne Rooney together up front and Man Utd should have had far too much fire-power for the visitors to handle.

Instead, roared on by 9,000 fanatical supporters, Leeds set about by first frustrating the hosts and then taking the game to them.

Man Utd had most of the early possession but Leeds were not panicking when they did get the ball, and stunned the home crowd when they took the lead after 19 minutes.

Beckford escaped Wes Brown to latch onto Johnny Howson's superb lofted pass and, although his first touch was poor, he recovered to coolly slide the ball past Tomas Kuszczak and into the bottom corner of the net.

It was the kind of finish which showed why Beckford is one of the most sought-after strikers outside the top-flight and might mean Newcastle have to spend a little more than they hoped if they are to prise him away from Elland Road in the transfer window.

It almost got even better for Leeds two minutes later when the impressive Howson broke forward down the right and sent over an inviting cross that Luciano Becchio headed wide.

Only then did Man Utd come forward with intent and they came agonisingly close to levelling when Berbatov released Rooney down the right. The England striker made for goal and clipped his shot over keeper Casper Ankergren but Jason Crowe got back superbly to hack the ball off the line.

Rooney and Danny Welbeck both tried their luck with curling shots from the edge of the box that were both just off target and Jonny Evans headed wide after Ankergren flapped at a corner but otherwise the home side were unable to break down Leeds' determined defence.

The game continued in the same vein after the break, with Man Utd pressing but struggling to create clear-cut chances and Ankergren proving a reliable last line of defence when the home side did get a sight of goal.

He saved brilliantly from Welbeck but otherwise they failed to really threaten an equaliser until the final half-hour.

By then, Antonio Valencia and Ryan Giggs were off the bench - soon to be joined by Michael Owen - and at last Man Utd looked dangerous, only to be thwarted by some dreadful finishing.

Owen miscued with the goal gaping after Valencia teed him up and Rooney was also wildly off target when the ball fell to him in the box.

Leeds were not just defending either, and could have extended their lead before the end when Beckford fired wide after running through and substitute Robert Snodgrass smashed a rasping free-kick against the bar.

In the end, however, one goal was enough to send Leeds through to round four and show why Grayson is rated one the most promising young managers in the game.

To paraphrase Alexander Pope; Hope does spring eternal.

Back then, in February 2004, Leeds earned a 1-1 draw at Old Trafford thanks to a goal from Alan Smith — but the club was falling apart at the seams. A sustained bout of extravagant spending on expensive, high-earning players such as Robbie Keane, Rio Ferdinand, Mark Viduka and Olivier Dacourt had taken them to the semi-finals of the Champions League (in 2001), but also created a financial timebomb that was in the midst of exploding.

pix from here.

pix from here.

Leeds chairman Peter Ridsdale and manager David O’Leary had been gambling money they didn’t have in an over-ambitious attempt to become regular Champions League contestants and thereby earn back the money they had already spent. When those heady levels of success proved elusive, they were stuck with a debt mountain that nobody was in a position to pay off.

Players were sold in a desperate attempt to balance the books, leaving an inexperienced squad with insufficient quality to compete in the Premier League, never mind on the European stage. With Ridsdale, O’Leary and their superstar signings long since departed, Leeds were relegated in May 2004. But the financial scars remained and they continued to spend beyond their means. Three years later, they were relegated again, placed into administration and very nearly ceased to exist.

Now, it seems Leeds are making strides on the long road back to regaining the top-flight status they have enjoyed for the vast majority of their history. With their debts finally paid off (or waived), they’re currently eight points clear at the top of League One, promotion to the second tier looking almost certain. But there’s still a long way to go before former glories are restored, if they ever are.

Leeds’ descent and fall was so spectacular that you’d expect it to serve as a cautionary example for other ambitious clubs — a kind of textbook on how not to run a Premier League football club. But it hasn’t. Their tale of woe is far from solitary, and it seems inevitable that other clubs will continue to follow them all too eagerly down the fast-lane motorway to ruin.

Southampton, for example, spent 27 consecutive seasons in the top flight before getting too big for their boots, deciding they could become a top-six club and spending accordingly. One bad season was enough to relegate them in 2005, a year after Leeds, and they’re now in the middle reaches of League One after narrowly fighting off extinction in the summer.

A few miles along the south coast, Portsmouth’s situation looks even more perilous. Years of unsustainable investment brought the short-term glory of winning the FA Cup in 2008 but the long-term damage of massive debts and no way of paying them.

Having been forced to sell all their best players (Peter Crouch, Jermain Defoe, Glen Johnson and Nico Kranjcar, to name but four), Pompey are currently firmly rooted to bottom place in the Premier League, forbidden from conducting any transfers until debts from previous purchases are paid off, have just failed to pay their players on time for the third time in four months, and have been given a winding-up order over unpaid tax bills. Did they learn nothing from Leeds?

West Ham will be looking forward to tomorrow’s cup tie with Arsenal as an opportunity to cause an upset, but they’re not too far behind Portsmouth on the road to oblivion. The story is familiar –—over-investment in average players (£80,000 (RM440,000) per week for Lucas Neill?!), unsustainable spending, then panic selling of key assets, leading to an uncompetitive squad and the threat of relegation. If West Ham are relegated at the end of the season, they could become another Leeds.

These financial implosions will continue to unfold as long as the Premier League remains the unregulated free-market scramble for success that it is today. With no central controls on spending, clubs are left to make their own decisions about how and where they invest, leaving directors and managers free to chase their unrealistic ambitions and bring their clubs to the verge of meltdown.

When they watch Leeds taking on the champions at Old Trafford tomorrow, everybody connected with a professional football club in England should realise how far and how easily the mighty can fall if financial mismanagement is allowed to take control. They should see a club that was once regarded as one of the game’s powerhouses now reduced to enjoying an occasional day in the sun for a cup tie that has little meaning for their opponents. They should understand that splurging vast sums of borrowed money in the pursuit of success is not the wisest strategy. They should, but they won’t.

OTHER than being an ingredient of the more recherché sorts of salad, herbal tea or wine, dandelions are pretty useless plants. Or, at least, they were. But one species, a Russian variety called Taraxacum kok-saghyz (TKS), may yet make the big time. It produces molecules of rubber in its sap and if two research programmes, one going on in Germany and one in America, come to fruition, it could supplement—or even replace—the traditional rubber tree, Hevea brasiliensis.

Despite the invention of synthetic rubbers, there is often no good substitute for the real thing, for nothing artificial yet matches natural rubber’s resilience and strength. This is because natural-rubber molecules, the product of a stepwise synthesis by enzymes, have a more regular structure than the artificial ones made by chemical engineering. Around a fifth of an average car tyre is therefore made of natural rubber. In an aeroplane tyre that figure can be more than four-fifths. Moreover, the price of synthetic rubber is tied to that of the oil from which it is made, rendering it vulnerable to changes in the oil price. Because oil is likely to become more costly in the future, natural rubber looks an attractive alternative from an economic point of view as well as an engineering one.

Natural rubber has problems, though. Growing Hevea in the Americas is hard. A disease called leaf blight means the trees have to be spaced widely. Even in Asia, currently blight-free, planting new rubber trees often means cutting down rainforest, to general disapproval. And trees, being large, take time to grow to the point where they can yield a crop. A smaller plant that could be harvested for its rubber therefore has obvious appeal. One proposal is to use guayule, a shrub that grows in arid regions and produces rubber that is free from allergenic proteins, which makes it useful for items such as surgical gloves. Desert plants, however, tend to be slow growing—guayule takes two years to mature. Yulex, a firm that has commercialised guayule, gets an annual crop of 400 kilograms per hectare. Hevea can yield four or five times that figure. Which is where TKS could come in. Dandelions are regarded as weeds for a reason—they are robust, fast-growing plants that can be pulled up for processing and resown easily, possibly yielding two harvests a year. If they could be turned into usable crops, they could outstrip even Hevea.

To this end, Christian Schulze Gronover of the Fraunhofer Institute for Molecular Biology and Applied Ecology in Aachen, Germany, and his colleagues have identified the genes that allow TKS to produce usable rubber. In particular, they have discovered an enzyme called polyphenoloxidase that is responsible for making its rubbery sap coagulate.

From the plant’s point of view this coagulation is a good thing. The evolutionary purpose of rubber, and the reason why it has appeared independently in plants as diverse as trees, guayule and dandelions, is that it gums up the mouthparts of herbivorous insects. Human users, however, do not want it to coagulate too soon, and Dr Schulze Gronover has found a way to switch polyphenoloxidase off, using a technique called RNA interference. This intercepts and destroys the molecular messengers that carry instructions from the polyphenoloxidase gene to make the enzyme, meaning that rubber can be extracted more easily from the plant.

Meanwhile, in America Matthew Kleinhenz of Ohio State University is working on increasing the yield of rubber from TKS. Dr Kleinhenz is doing things the old-fashioned way, growing different strains of TKS, grinding up the roots (where most of the sap is found) to see which have the highest rubber content, and crossbreeding the winners. His aim is to create a plant that is both high-yielding and has roots chunky enough to be harvested mechanically by the sort of device now used to pick carrots.

Combining the two approaches—high-tech bioengineering and low-tech plant breeding—may produce that rarity in the modern world, a whole new crop species. It would also mark a step on a journey that some see as the way forward: a return to the use of plant-based products that have, briefly, been overshadowed by the transient availability of cheap oil.